Demystifying Medicare: Your Complete Guide to Health Coverage

Medicare plays a crucial role in ensuring access to healthcare for millions of Americans. Understanding the complexities of this government program can seem daunting, but fear not! In this comprehensive guide, we will demystify Medicare and provide you with all the information you need to navigate health coverage with confidence.

Health insurance is essential for safeguarding our well-being, and that's where Medicare comes in. It is a federal program that primarily caters to individuals aged 65 and older, but it also extends coverage to certain younger people with disabilities. Medicare is divided into different parts, each serving a specific purpose. Let's dive into the intricacies of Medicare Part A, Part B, Part C, and Part D, collectively known as Original Medicare, and uncover what they entail.

Original Medicare is a combination of Part A, which covers hospital insurance, and Part B, which provides medical insurance. Part A helps cover services such as inpatient hospital stays, skilled nursing facilities, hospice care, and limited home healthcare. On the other hand, Part B covers medically necessary services like doctor visits, preventive care, outpatient care, and durable medical equipment. It's important to note that while Part A generally does not require a premium, Part B does involve a monthly premium based on your income.

Stay tuned as we delve further into the ins and outs of Medicare, discussing additional plans like Medicare Advantage, Part D Prescription Drug Plans, and Medigap, which can help fill the gaps in Original Medicare coverage and provide additional benefits. We'll also explore the enrollment process, eligibility requirements, costs, benefits, and various other facets of Medicare that you need to know to make informed decisions regarding your healthcare.

Oh, and did we mention Medicare Open Enrollment? We'll walk you through this crucial annual period when you can make changes to your Medicare coverage, ensuring that you have the best fit for your needs. Additionally, we'll shed light on Medicare Advantage Disenrollment Period and Medicare Advantage Special Needs Plans, which cater specifically to individuals with unique healthcare requirements. And if you're worried about your financial situation, fear not—we'll uncover Medicare Savings Programs designed to assist with healthcare costs.

So, let's embark on this journey together to demystify Medicare and equip you with the knowledge to navigate the world of health coverage confidently. Whether you're approaching Medicare for the first time or seeking to optimize your existing coverage, this guide will empower you to make well-informed decisions about your health and well-being. Let's get started!

Understanding Medicare Options

Medicare offers a variety of options to meet your health coverage needs. It's important to understand these options so you can make informed decisions about your healthcare. Here, we will break down the different parts of Medicare and explain what they cover.

Original Medicare (Parts A and B)

Original Medicare is the traditional, fee-for-service health insurance program offered by the federal government. It consists of two main parts: Part A and Part B.

Medicare Part A provides coverage for inpatient hospital care, skilled nursing facility care, hospice care, and some home healthcare services. This includes things like hospital stays, nursing care, and limited home healthcare services.

Medicare Part B covers medically necessary services and preventive care, such as doctor visits, outpatient care, laboratory tests, and durable medical equipment. It also covers certain vaccines and screenings to help detect and prevent illnesses.

Medicare Advantage (Part C)

Medicare Advantage, also known as Part C, is an alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare. Medicare Advantage plans provide the same coverage as Original Medicare (Parts A and B), but often include additional benefits like prescription drug coverage, dental, vision, and hearing services, and wellness programs.

Medicare Prescription Drug Plans (Part D)

Medicare Part D is a separate prescription drug coverage option available to those with Original Medicare or Medicare Advantage plans that do not include drug coverage. These plans are offered by private insurance companies and help pay for prescription medications. It's important to choose a plan that covers the specific medications you need and has a pharmacy network that is convenient for you.

Understanding these different options of Medicare can help guide your decision-making process when it comes to your healthcare coverage. Stay tuned for the next sections where we will discuss eligibility, enrollment, and other important factors to consider.

Navigating Medicare Enrollment

When it comes to enrolling in Medicare, understanding the different parts and enrollment periods is key. Let's break down Medigap Plans Cost Virginia to help you navigate the process smoothly.

Medicare Parts A and B: Original Medicare

Medicare is divided into different parts, and the primary components are Part A and Part B, collectively known as Original Medicare. Part A provides coverage for hospital stays, nursing care, and some home health services. Part B covers doctor visits, preventive services, and outpatient care.

Medicare Parts C and D: Additional Coverage Options

In addition to Original Medicare, there are other coverage options available. Medicare Part C, also known as Medicare Advantage, is offered by private insurance companies approved by Medicare. These plans often include prescription drug coverage and may offer additional benefits such as vision or dental services.

Medicare Part D is a standalone prescription drug plan that helps cover the costs of medications. This coverage can be added to Original Medicare, and it's also included in some Medicare Advantage plans.

Medicare Enrollment Periods

It's important to be aware of the different enrollment periods for Medicare. The Initial Enrollment Period (IEP) is when most individuals first become eligible for Medicare, which is typically around their 65th birthday. This seven-month period includes the three months before their birthday month, the birthday month itself, and the three months after.

Another significant enrollment period is the Annual Enrollment Period (AEP), also known as the Medicare Open Enrollment period. This period, which runs from October 15th to December 7th each year, allows individuals to make changes to their Medicare coverage for the following year. During this time, you can switch between Original Medicare and Medicare Advantage, join or change Medicare Part D plans, or enroll in a Medicare Supplement Plan (Medigap).

In addition to the IEP and AEP, there are also Special Enrollment Periods (SEPs) that may apply to certain situations, such as moving out of your plan's service area or losing employer health coverage.

Understanding Medicare enrollment periods will help ensure you make the right decisions about your healthcare coverage. Stay informed and take advantage of the appropriate enrollment period to secure the Medicare benefits that best suit your needs.

Managing Medicare Costs

Medicare Costs: Medicare provides essential healthcare coverage for eligible individuals, but it's essential to be aware of the costs associated with this program. Understanding the different expense components can help you effectively manage your Medicare costs.

Part A and Part B Costs: Medicare Part A, also known as hospital insurance, typically does not require a monthly premium if you or your spouse has paid Medicare taxes while working. However, there may be deductibles, coinsurance, or copayments associated with Part A services. On the other hand, Medicare Part B, which covers medical services, does require a monthly premium. The premium amount is based on your income and every year there is an opportunity to review and adjust these rates.

Managing Costs Effectively: To maximize your Medicare coverage and minimize costs, it's important to evaluate your healthcare needs and determine the most suitable Medicare plan for you. One way to do this is by considering Medicare Advantage plans (Part C), which are offered by private insurance companies as an alternative to Original Medicare (Part A and Part B). These plans often provide additional benefits, including prescription drug coverage (Part D), and may have lower out-of-pocket costs. It's worth noting that there are specific enrollment periods for Part C plans, so be sure to familiarize yourself with these dates.

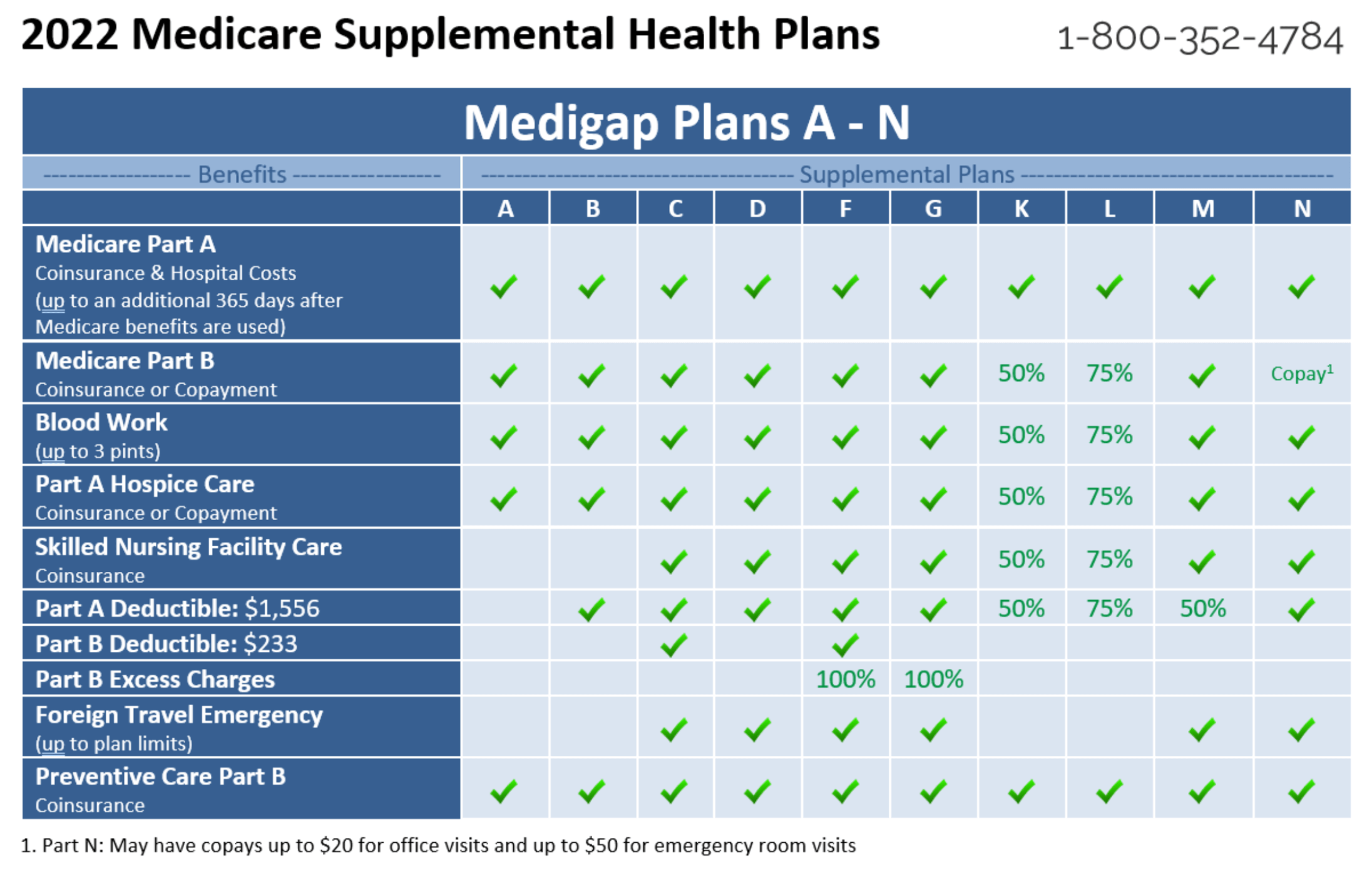

Another way to manage Medicare costs is by considering Medicare Supplement plans, also known as Medigap. These plans work alongside Original Medicare and can help cover some of the out-of-pocket expenses such as deductibles, copayments, and coinsurance. Medigap plans are offered by private insurance companies and have different coverage options to choose from.

Additionally, be aware of Medicare Open Enrollment periods as they present an opportunity to review and make changes to your Medicare coverage. During this period, you can switch between Original Medicare and Medicare Advantage plans, as well as review your Part D prescription drug coverage.

Remember, managing Medicare costs involves understanding the various components of the program, evaluating your healthcare needs, and exploring different Medicare plans available to you. By staying informed and making informed decisions, you can ensure that your Medicare coverage remains comprehensive and cost-effective.